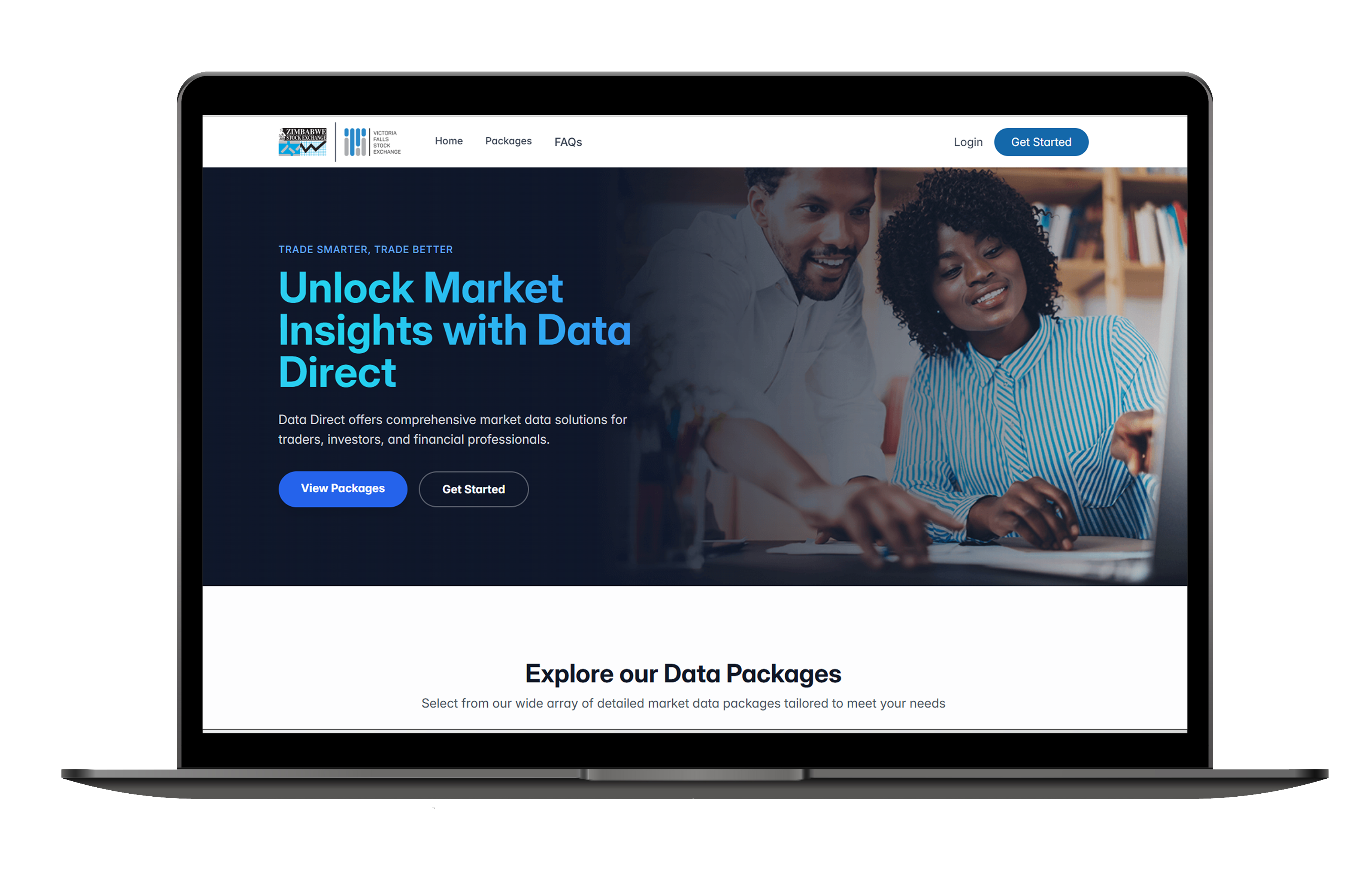

Introducing Data Direct

Data Direct Packages

End of Day Reports

Explore the end-of-day data packages and select a subscription plan that best suit your needs. You can conveniently view or download end-of-day reports and historical data directly from the platform. End-of-day reports remain available for viewing and downloading for 10 business days, while historical data is accessible for the duration of the selected period.

Historical Data

ZSE & VFEX Historical Data constitutes a meticulously curated repository of past daily trading metrics, encompassing prices, trading volumes, turnover values, indices and market capitalizations. This comprehensive dataset offers an intricate lens through which market dynamics can be scrutinized, enabling astute analysts to discern patterns, extrapolate trends, and derive empirically grounded insights.

Live Data (View Only Terminal)

The View Only Terminal (VOT) package provides viewing rights to live trading on the ZSE and VFEX, enabling clients to access real-time market information and view market movements. A link to the Automated Trading System (ATS) Easy Trade platform will be provided to subscribed clients to access live data.